Travel trailer title loans are becoming a popular way for people who own an RV, trailer, or camper to access fast cash. If you need funds for personal or emergency expenses, a title loan could be a solution.

With a travel trailer title loan, you can use your RV’s title as collateral, meaning the lender uses it to secure the loan. You don’t need perfect credit to qualify, which makes it an accessible option for those with bad credit or no credit history.

Who This Guide is For

This guide is for anyone looking to understand how travel trailer title loans work in Kyle, TX. Here, you’ll find everything you need to know about the process, eligibility, interest rates, and how to get approved quickly. Whether you’re new to title loans or exploring options to finance your RV dreams, this guide covers it all in an easy-to-follow way.

What is a Travel Trailer Title Loan?

Defining Title Loans for Travel Trailers and RVs

A title loan is a secured loan that uses your travel trailer’s title as collateral. In simple terms, this means that you’re borrowing money against the value of your RV or trailer. If you own a travel trailer outright, a title loan can help you access funds based on the vehicle’s market value. You keep using your RV as usual, but the lender holds the title until you repay the loan.

Why Choose a Title Loan for Your RV?

Title loans are often preferred because of their flexibility and quick approval process. Here’s why they’re a good fit:

- Quick Access to Funds: Since the RV or travel trailer itself secures the loan, lenders are more willing to approve these loans quickly.

- No High Credit Requirements: Unlike traditional loans, title loans don’t place much emphasis on your credit score. If you have bad credit, this option may be more accessible.

- Installment Payment Options: Title loans typically offer installment payments, which make it easier to repay over time.

- Collateral: Using your travel trailer or RV as collateral provides added security for the loan, making it easier for you to qualify even with low credit.

Popular Travel Trailer and RV Models Eligible for Title Loans

If you own popular RV brands or models like Forest River, Airstream, or Grand Design Reflection, you’re likely eligible for a title loan. These brands are commonly accepted as collateral because of their market value and reliability. Both new and pre-owned models are eligible, meaning you can use either as security for your loan.

How Travel Trailer Title Loans Work in Kyle, TX

Basic Eligibility Requirements for Title Loans

To qualify for a travel trailer title loan in Kyle, TX, you’ll need to meet certain requirements:

- Ownership of the RV or Travel Trailer: You must own the trailer outright, with a clear title.

- Proof of Income: This could be a pay stub, bank statement, or other proof of financial stability.

- Valid Identification: A driver’s license or other government-issued ID.

- Texas Residency Proof: Since this loan is for Kyle, TX residents, you may need proof of address, such as a utility bill.

Loan Application Process Explained

The application process for a travel trailer title loan is straightforward and often takes less time than traditional loans. Here’s what to expect:

- Online vs. In-Person Application Options

Many lenders now offer online applications for added convenience, letting you apply from anywhere, anytime. However, some lenders offer in-person applications, allowing you to interact with a loan officer directly if you have questions. - Documents Needed for Loan Approval

Typical documents include your RV or trailer title, proof of income, and identification. Some lenders may also require proof of mileage or the trailer’s condition.

Fast Approval Process in Kyle, TX

Once you submit your application and required documents, the approval process usually takes only a business day. This fast approval is a big plus for anyone needing funds urgently.

Understanding Government and Registration Fees

Some fees may apply, including government and registration fees, depending on your trailer’s value and Texas requirements. These fees vary, so it’s best to check with your lender on specific costs.

Why Consider a Travel Trailer Title Loan if You Have Bad Credit?

Credit Score Requirements and Flexibility

Title loans are more accessible to people with lower credit scores because they rely on the value of the trailer as collateral. If you’re concerned about bad credit, a title loan might still be a great option to consider since it’s based more on the trailer’s value than your credit history.

Comparing Credit Unions and Traditional Lenders for Title Loans

While credit unions may offer title loans, traditional lenders are often more flexible regarding eligibility and customer service. Credit unions sometimes have stricter requirements, while traditional lenders cater to a broader range of credit scores.

Impact of Title Loans on Your Credit History

Making timely payments on a title loan could even help boost your credit score. However, defaulting on payments may negatively impact your credit, so it’s essential to borrow responsibly.

Exploring Different Financing Options in Kyle, TX

Car Title Loans vs. RV Title Loans

Car title loans are similar to RV title loans but use your car as collateral instead. For those who own an RV or travel trailer, an RV title loan may offer better terms and higher loan amounts due to the higher value of the collateral.

Payday Loans vs. Title Loans

Unlike payday loans, which are typically short-term and have high-interest rates, title loans may offer a more manageable repayment plan over several months. They’re also typically based on the value of your trailer, not your next paycheck.

RV Financing Through Dealerships

Some RV dealerships in Kyle, TX, offer in-house financing options that could be worth exploring, especially if you’re buying a new or used RV directly. These options sometimes come with lower rates for customers with good credit scores.

Understanding Loan Rates and Interest Rates

Interest rates on title loans vary based on factors like your credit score, income, and the trailer’s value. Title loans may have higher rates than traditional loans, but lower than payday loans.

Tips to Improve Your Approval Odds for a Travel Trailer Title Loan

Steps to Improve Your Credit Scores

Before applying, consider steps to boost your credit, such as paying down existing debts or making timely payments. Higher scores could potentially lead to better loan terms.

Finding Lower Loan Rates and Interest Options

Shop around for lenders that offer competitive rates, and ask about any pre-approval options that may help you secure favorable terms.

Choosing a Lender with Good Customer Service

Opt for a lender with strong customer service, as they’ll help ensure you understand each step of the loan process and answer any questions you have.

How to Find Travel Trailers for Sale and Title Loans Near Kyle, TX

Where to Look for Pre-Owned Travel Trailers

You can find travel trailers for sale on sites like RV Trader or through local dealerships in excellent condition and at reasonable prices.

Recommended RV Dealers in Kyle, TX

Local RV dealers in Kyle often have a range of options for both new and used travel trailers. Check them out to find an RV that meets your needs and potentially qualifies for a title loan.

Online Marketplaces for Travel Trailers

Popular online marketplaces like RV Trader list specifications and conditions for different RVs, giving you a broad view of available options in your area.

What is a Travel Trailer Title Loan?

Defining Title Loans for Travel Trailers and RVs

A title loan is a secured loan where the title of your RV or trailer acts as collateral. This means that you’re borrowing money against the value of your RV, making it a more accessible loan type if you have poor credit or limited financing options.

Why Choose a Title Loan for Your RV?

Title loans are popular due to their flexibility and quick approval process. Key benefits include:

- Quick Access to Funds: Title loans are typically faster to approve than traditional loans.

- Less Emphasis on Credit: Bad credit is less of a barrier as the loan is based on the RV’s value.

- Installment Payment Options: Title loans often come with installment options, making it easier to repay over time.

Popular Travel Trailer and RV Models Eligible for Title Loans

Brands like Forest River, Airstream, and Grand Design Reflection are widely accepted for title loans. New and used models are eligible, allowing more RV owners to qualify for financing.

How Travel Trailer Title Loans Work in Kyle, TX

Basic Eligibility Requirements for Title Loans

Eligibility requirements are generally straightforward:

- Clear Title: You must own the RV outright with no outstanding loans.

- Proof of Income: Lenders require proof of income to ensure loan repayment.

- Valid ID: Government-issued identification is typically required.

- Texas Residency: Some lenders may ask for proof of residency in Texas, such as a utility bill.

Loan Application Process Explained

The process for applying for a travel trailer title loan can be completed online or in person. Here’s a breakdown:

- Online vs. In-Person Application Options

Online applications provide convenience, while in-person options allow for direct communication with a loan officer. - Documents Needed for Loan Approval

Key documents include the RV title, proof of income, ID, and sometimes proof of the trailer’s mileage or condition.

Fast Approval Process in Kyle, TX

Title loans are often approved within one business day, making them a quick option for emergency financing.

Understanding Government and Registration Fees

Government fees, like registration and title transfer fees, may apply. These fees vary based on the trailer’s value and Texas state requirements.

Understanding the Value of Your Travel Trailer for a Title Loan

How is Loan Value Determined?

The value of your RV or trailer largely determines the loan amount. Factors influencing this value include the trailer’s age, mileage, brand, model, and overall condition.

Estimating the Value of Your RV Before Applying

To get an idea of your trailer’s worth, you can use online valuation tools or request an appraisal from a local dealership. Knowing this value helps you set realistic expectations for your loan amount.

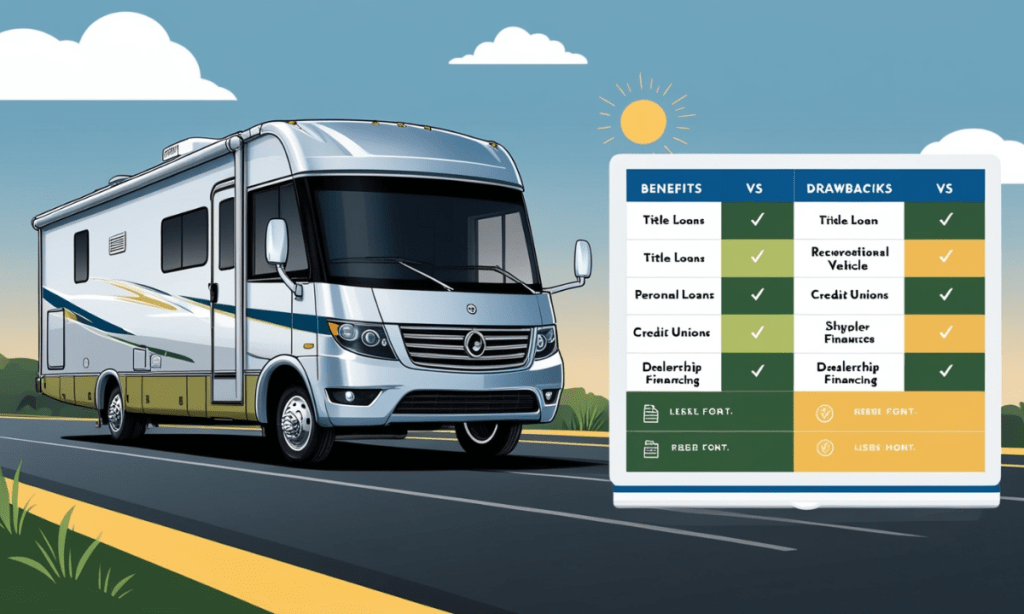

Comparing Title Loans with Other RV Financing Options

Personal Loans vs. Title Loans for RVs

Personal loans don’t require collateral but are based on creditworthiness. Title loans, however, may offer better terms for RV owners because the loan amount is secured by the trailer’s value.

Dealer Financing vs. Title Loans

Dealer financing is typically offered for new RV purchases, which might offer better rates for buyers with good credit. Title loans are more suited for owners needing immediate funds without purchasing a new trailer.

Understanding Interest Rates and Terms for Title Loans

Typical Interest Rates for Title Loans

Interest rates for title loans tend to be higher than traditional loans due to their short-term nature. Rates vary, so it’s best to compare lenders to find the most competitive option.

Loan Term Options

Loan terms usually range from a few months to a couple of years. Short-term options may have higher monthly payments but lower overall interest.

Repayment Options for Travel Trailer Title Loans

Monthly Payment Options

Most title loans offer monthly installment plans, allowing you to pay back the loan in manageable amounts over time. Your monthly payment is usually based on the loan term, interest rate, and amount borrowed.

Early Repayment Options

Some lenders allow early repayment without penalties, which can help you save on interest. It’s a good idea to confirm early repayment terms with your lender before signing the agreement.

Risks and Considerations of Travel Trailer Title Loans

Risk of Repossession

If you fail to make loan payments, the lender has the right to repossess your trailer. Always borrow within your means and ensure you can meet the payment terms.

Potential Impact on Credit Score

Timely payments on a title loan can have a positive effect on your credit, while missed payments may damage it. Being prompt with payments is essential to avoid any negative impact.

Assessing Your Ability to Repay the Loan

Calculate your monthly expenses to ensure the loan payments fit comfortably into your budget, avoiding financial stress or missed payments.

My Opinion

Travel trailer title loans in Kyle, TX, provide a quick way to access funds by using your RV or trailer as collateral. With minimal credit requirements, these loans are accessible even to those with bad credit.

The article covers the loan process, eligibility criteria, necessary documents, and typical interest rates, along with comparing title loans to other financing options. It also addresses potential risks, repayment options, and tips to improve approval chances. Ideal for those needing fast cash, the guide highlights the benefits of title loans and offers practical steps to ensure a smooth application experience.